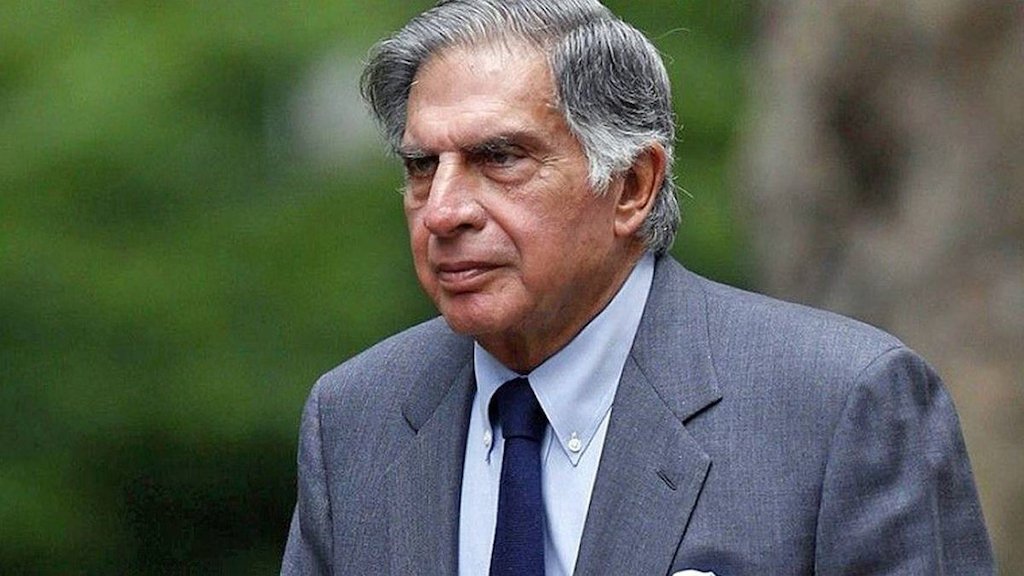

Dheeraj Wadhawan, the former director of Dewan Housing Finance Limited (DHFL), found himself in judicial custody following his appearance before a special court in Delhi. This development came after the Central Bureau of Investigation (CBI) arrested him in connection to a staggering Rs 34,000-crore bank fraud case.

Officials disclosed that Wadhawan was apprehended in Mumbai on Monday evening and presented in court the following day. Notably, he had already been charge-sheeted by the CBI in relation to this case back in 2022.

This isn’t Wadhawan’s first brush with legal trouble; previously, he was arrested by the agency in connection to the Yes Bank corruption case, albeit being out on bail, as per officials.

The DHFL case under CBI scrutiny involves an alleged defrauding of a consortium of 17 banks to the tune of Rs 34,000 crore, marking it as one of the largest banking loan frauds in the nation.

The investigation against the Wadhawan brothers revolves around allegations of “cheating” the aforementioned consortium of banks, amounting to Rs 34,615 crore, according to statements from the Enforcement Directorate (ED). This case also involves accusations of money laundering originating from the CBI’s First Information Report (FIR).

The modus operandi allegedly involved Kapil Wadhawan, Dheeraj Wadhawan, and other accused individuals conspiring to deceive the consortium of banks led by Union Bank of India (UBI). Under this conspiracy, Kapil Wadhawan and accomplices purportedly induced the consortium banks to grant substantial loans totaling Rs 42,871.42 crore.

Subsequent investigations revealed that the accused parties purportedly embezzled a significant portion of these funds by manipulating DHFL’s records and failing to repay the legitimate dues owed to the consortium banks, resulting in a loss of Rs 34,615 crore to the lenders.

Earlier this year, the Securities Exchange Board of India (SEBI) ordered the attachment of bank accounts, shares, and mutual fund holdings belonging to former DHFL promoters Dheeraj and Kapil Wadhawan, in a bid to recover dues amounting to ₹22 lakh. This action was taken after the Wadhawan brothers failed to pay a fine imposed on them in July of the previous year for breaching disclosure norms.

In July 2023, SEBI imposed a penalty of ₹10 lakh each on the Wadhawans for flouting disclosure norms during their tenure as promoters of DHFL, now rebranded as Piramal Finance.

Kapil Wadhawan served as the Chairman and MD of DHFL, while Dheeraj Wadhawan held a non-executive director position within the company.

In a separate legal maneuver, the Delhi High Court recently issued a notice to the CBI in response to Dheeraj Wadhawan’s plea for bail on medical grounds. Wadhawan sought relief from a trial court’s denial of bail, citing medical reasons. He is presently undergoing medical treatment at his Mumbai residence following spinal surgery. Justice Jyoti Singh has directed the CBI to respond, with the next hearing scheduled for May 17.