In the ever-volatile world of global finance, the Japanese yen has once again taken center stage, causing ripples across markets worldwide. It would be an understatement to say that this year’s activity on the Japanese stock market has been quite unpredictable.

At its peak in July, the benchmark Nikkei 225 index for Japan had gained over 27% for the year. Then August occurred. August 5 saw a dramatic collapse in stock values, falling 12% in a single day for the first time since Black Monday. This brought the total slide from the peak in July to 27%.

The Nikkei then saw its largest one-day increase since 2008 on August 6, and it has been gradually rising ever since.

Let’s dive into the latest developments and what they mean for investors.

The Yen’s Wild Ride

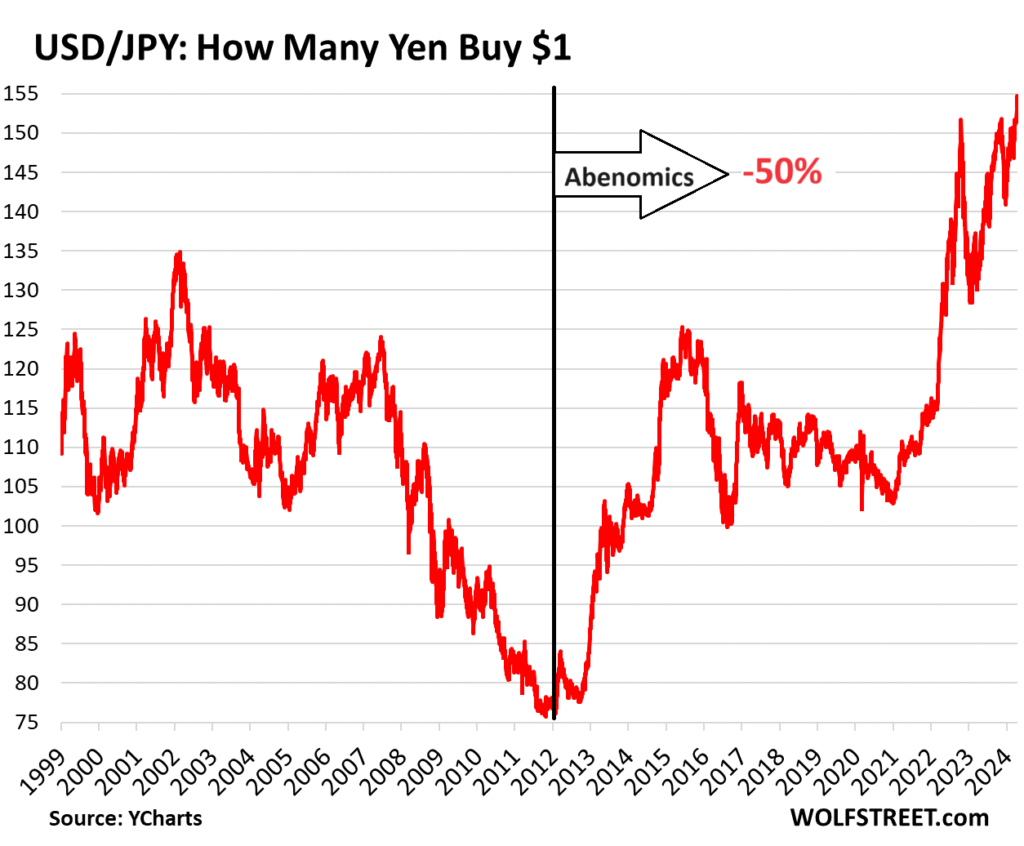

After a dramatic surge that sent shockwaves through global markets, the yen has finally taken a breather. The currency dipped slightly against the dollar, providing a momentary respite for traders still reeling from last week’s tumultuous events. But don’t be fooled – this story is far from over.

The recent upheaval stems from the unwinding of the infamous “yen carry trade,” a strategy that had become a darling of investors worldwide. For years, traders borrowed yen at rock-bottom interest rates to invest in higher-yielding assets elsewhere. It was a lucrative game – until it wasn’t.

The Bank of Japan’s surprise rate hike threw a wrench into this well-oiled machine. As the yen strengthened, carry traders scrambled to unwind their positions, triggering a domino effect across global markets.

Market Mayhem: By the Numbers

Let’s break down the carnage:

1. The S&P Global Broad Market Index plummeted 3.3% – its worst day in over two years.

2. Japan’s TOPIX index suffered a staggering 20% drop in just three days.

3. Cryptocurrencies weren’t spared, with the Bloomberg Galaxy Crypto Index nosediving up to 17.5%.

But here’s the kicker: JPMorgan analysts believe we’re only halfway through this unwinding process. Buckle up, folks – there might be more turbulence ahead.

The Inflation Wild Card

As markets attempt to find their footing, all eyes are now on upcoming US inflation data. This critical piece of economic intelligence could either calm the waters or whip up another storm.

If inflation shows signs of cooling, it could bolster expectations of Federal Reserve rate cuts later this year. While this might sound like good news, it could actually exacerbate the yen carry trade unwind by making the dollar less attractive relative to the yen.

On the flip side, hotter-than-expected inflation could force the Fed to maintain its hawkish stance, potentially providing some stability to currency markets – but at the cost of equity market gains.

Navigating the Storm: Investor Strategies

In these choppy waters, what’s an investor to do? Here are some key points to consider:

1. Diversification is your lifeline: Don’t put all your eggs in one basket, especially not in carry trade-sensitive assets.

2. Keep an eye on the yen: Its movements will continue to influence global market trends.

3. Stay liquid: In times of volatility, having cash on hand can be a valuable asset.

4. Watch for opportunities: Market dislocations often create attractive entry points for long-term investors.

5. Don’t panic: Remember, markets have weathered storms before and will do so again.

Looking Ahead

As we navigate these turbulent times, one thing is clear: the era of easy money and predictable carry trades is coming to an end. The unwinding of the yen carry trade is not just a fleeting market event – it’s a signal of a broader shift in the global financial landscape.

Smart investors will stay nimble, keep a close eye on economic data, and be prepared for continued volatility. After all, in the world of finance, it’s not about predicting the future – it’s about being prepared for whatever it may bring.

Stay tuned, stay informed, and most importantly, stay calm. The market’s wild ride is far from over, but with careful navigation, there are always opportunities to be found amidst the chaos.

Real Estate Pretty! This has been a really wonderful post. Many thanks for providing these details.

Internet Chicks Good post! We will be linking to this particularly great post on our site. Keep up the great writing

YouJizz Incredibly informative articles and reviews at the moment

Noodlemagazine Lovely work! This has been an amazing post. Many thanks for offering these details

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.